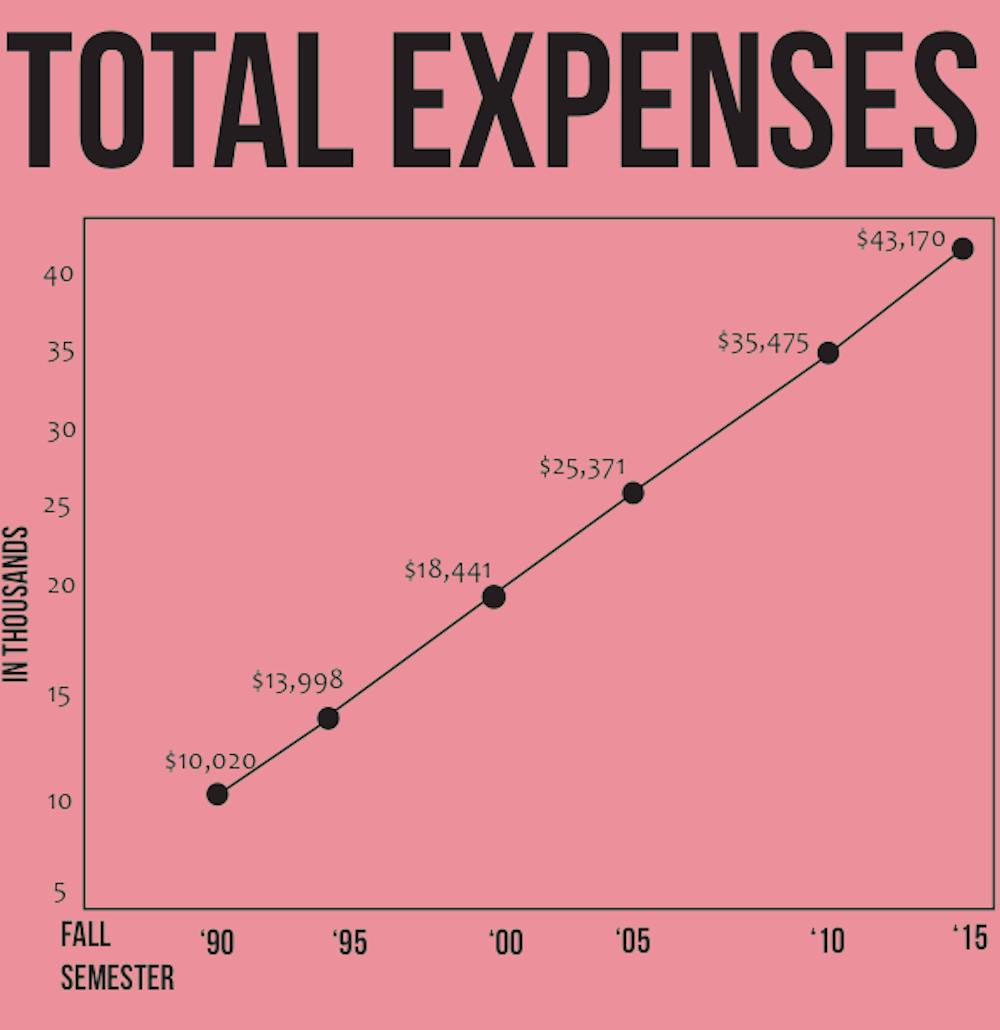

In an era in which the cost of college climbs higher and higher each year, Elon University recently delivered a bold statement with the rollout of its 2015-2016 fiscal year budget. Slashing the tuition increase to a 27-year low of 3 percent — down from last year’s 3.96 percent bump — the new spending plan was said by senior university officials to toe a hard line on the cost-quality conundrum.

Despite persistent student grumbles on the rising cost of higher education — at Elon and elsewhere — some constraints are concrete, according to Greg Zaiser, vice president of admissions and financial planning.

Rising inflation and increased operating costs associated with a growing campus make a net decrease now all but impossible for the university to offer to its wistful students, he said.

“Operational costs increase regularly,” Zaiser wrote in an email. “I have great respect and appreciation for our Board of Trustees, President Lambert and others for recognizing and addressing increasing costs of higher education. They have taken a significant stance by keeping next year’s total increase the lowest it has been in 27 years.”

Roped into a national higher education landscape that has shown few signs of slowing its scope, Elon’s hands are in some ways tied — it can be hard to cut costs while maintaining facilities and faculty on par with peer institutions who have more money to spend. To some, that says more about an underlying fault in U.S. education than it does about Elon in particular. w

“I’m happy it’s not going above what is was last year, but the only way to help reduce the student debt bubble, which is about to burst, is to lower tuition or keep it stable at the same rate even with inflation,” said Rebecca Sansale, a junior economics major.

The cost is far from lost on the people who set it.

“We understand this is a lot of money,” said Steven House, university provost and vice president for academic affairs. “It’s about balancing quality.”

Pointing to incremental raises in faculty salaries, while Elon has maintained in recent years a 12:1 student: teacher ratio, House went on to emphasize the need to spend to maintain educational quality — while being careful not to let spending get out of hand.

Carefully monitoring tuition dollars, which are a relatively sustainable source of funding, is necessary to maximize resources, he added.

“Tuition dollars can be spent that year,” he said. “We spend it to hire new faculty or to give more study abroad money. So, there’s this balance, and what we are finding is that more and more of the gifts to the university are targeted, rather than the university’s greatest need.”

The needs he mentioned are all relative ones, each unique in the eyes of the beholder.

“[Donors] really want to know what their money’s going toward,” House said. “When you say what Elon’s greatest need is, well, what’s it going to be? Is it going to the lightbulbs? Well, somebody’s got to pay for the lightbulbs.”

Increasing student loans

As default rates on student loans in the United States continue to hover at or near all-time highs, the Elon budget has stuck to its slow-but-steady policy of making more financial aid available for more students. Right now, about 40 million Americans are collectively saddled with upwards of $1.2 trillion in debt, and both figures are on the rise.

The average Elon student in 2013 (the most recent year with available data) took out $28,327 in a combination of federal and private loans to earn a degree, according to the Institute for College Access and Success (TICAS). That’s just s shade higher than the national average of $28,000 in loans taken out across the United States that year, though outliers who take on massive amounts of debt have been known to skew such statistics.

Limited by an $191 million endowment still in its infancy, compared to peer institutions such as the University of Richmond and its own valued at more than $2 billion, Elon as a tuition-dependent institution can only give so much, so often.

It can complicate things.

“There are certainly some challenges to being a tuition-dependent institution,” said Gerald Whittington, senior vice president for business, finance and technology, in a February 2014 interview with The Pendulum. Whittington deferred comment to House for this story. “If you’re growing slowly instead of really fast, you can get a double effect of covering the cost of education because you grew some and the tuition rate went up some.”

It’s tough to find a student or administrator or faculty member who supports the rising costs — people tend to paint the price tag shades of unpleasant, but necessary to the university’s present reputation and future prestige.

Under President Barack Obama, the federal government has made the cost of college a point of emphasis, but the amount of money loaned by the government has increased roughly 40 percent since 2013 alone.

Loans can make a college education accessible to those for whom it would otherwise be far out of reach, but what’s left behind is often less than pretty — shot credit, less-than-optimal employment prospects and the equivalent of another car or mortgage payment each month from loans and their dreaded interest.

“As a student, I’m happy I’m not going to have to pay more,” said junior Hunter Purvis, a history major who has some student loans he will eventually have to repay. “As a citizen of the United States, I think tuition prices are obscene across the board, and that’s something we’re going to have to face. It keeps education in the domain of the rich, or keeps you eternally poor.”

Planning for the future

As Elon continues to admit more students each, in keeping with the slow growth model outlined in the Elon Commitment, the goal for the Class of 2019 has been set at 1,450 — the same as this year’s freshman class. The numbers ought to fill semester-long gaps left by students studying abroad. The next school year, plans are in the works for a freshman class of 1,500, a relatively insignificant increase.

“Elon’s history is to set a goal and maintain it for several years,” Zaiser said. “That’s what we mean by slow, sustained growth.”

Coupled with growth, the smaller budget has led to questions about what might be left out moving forward, but House said the new direction should be thought of as prioritizing, rather than cutting. And it all goes back to keeping costs down, while providing the best possible education at the same time.

News Editor Caroline Fernandez and Assistant News Editor Katherine Blunt contributed reporting.