Tax-free online shopping may be at risk under a bill currently under consideration by the United States Senate. The bill would allow states to collect state and local sales taxes on all Internet purchases. The taxes would go to the state in which the consumer lives.

The current law allows states to collect sales taxes only if the company has a physical presence in the state, and as result, many online retailers charge no tax.

According to Steven Bednar, an assistant professor of economics at Elon University, many Internet businesses are not taxed for out-of-state sales due to a 1992 Supreme Court ruling on The Quill Corporation v. North Dakota. North Dakota attempted to impose a tax on Quill, an office supply retailer, but Quill did not maintain a physical location in the state. The court determined Quill did not have to pay tax under the Commerce Clause.

“The reason these transactions are not taxed stems from a decision made over 20 years ago, before Internet sales were big business,” said Bednar. “Taxing Internet sales seems like an obvious source to find revenue.”

President Barack Obama and supporters of the tax bill cite fairness and state revenue as benefits of the bill. According to Bednar, Congress is primarily looking for a source of revenue to help ease tight budgets at state and local levels.

“The bill effectively levels the playing field while at the same time raises revenue,” Bednar said.

In order for Congress to raise revenue through Internet sales tax, the economically efficient decision may be to institute a relatively low tax rate on a broad based of products.

“It is typically better to have lower tax rates on a broad base of goods because the deadweight loss — the value of transactions without taxes — typically rises with the square of the tax rate,” Bednar said.

Opponents to the bill suggest online tax creates problematic regulations for retailers and does not have enough protections for small businesses. Additionally, business with less than $1 million a year in Internet sales would be exempt from the taxes.

But not all businesses oppose the tax. According to Bednar, Amazon.com is in support of collecting online sales taxes in order to have building distribution centers in many locations to speed up delivery times.

“A changing retail landscape may mean there is less opposition for this type of tax from industry than there would have been five or 10 years ago,” says Bednar.

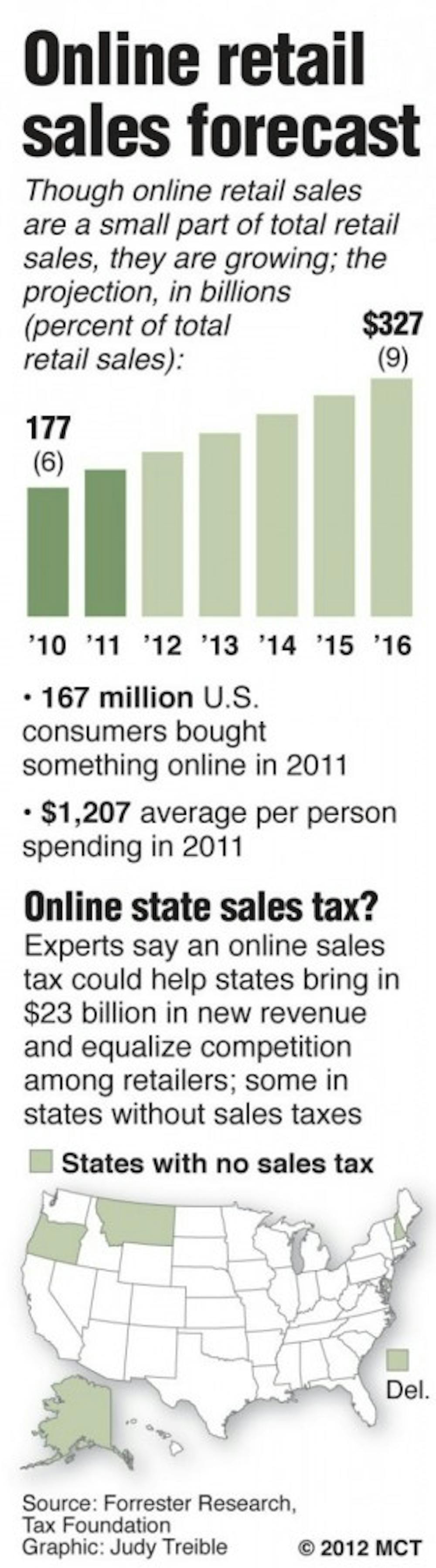

Last year, Internet sales in the United States totaled $226 billion, a 16 percent increase from the previous year. Typically, college students make up the majority of their purchases online from campuses around the country.

Elon University student Nicole Appleby says a sales tax will not limit her online purchases.

“I do not think a sales tax will cause college students to stop shopping online because there is no other way to shop while away at school,” says Appleby. “A small tax is worth it for the quickest and easiest online shopping.”

The legislation voted 63 to 30 on the legislation last month, and a final vote is scheduled for May 6.